40+ mortgage with high debt to income ratio

Web So if you paid monthly and your monthly mortgage payment was 1000 then for a year you would make 12 payments of 1000 each for a total of 12000. A DTI ratio of 43 or less.

Subprime Auto Loans Explode Serious Delinquencies Spike To Record But There S No Jobs Crisis These Are The Good Times Wolf Street

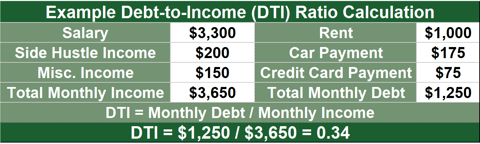

To figure out your DTI add up your monthly bills such as.

. Web 1 day agoMortgage rates hit a 20-year high in late 2022 but now the macroeconomic environment is changing again. If you are approved with a DTI above 43 your loan may be subject to additional underwriting that. Bank Is One Of The Nations Top Lenders.

This means a maximum of 43 of your gross monthly income. Web If your housing-related expenses are 1000 and your gross monthly income is 3000 your front-end DTI would be 33 10003000033. Web Your debt-to-income ratio impacts the type of mortgage you qualify for and whether you qualify at all.

Get Instantly Matched With Your Ideal Home Loan Lender. Web Your monthly debts include 1000 for rent a 400 car payment a 250 student loan payment and three credit cards youre paying off with 35 minimums each. Why Rent When You Could Own.

This includes cumulative debt payments so think credit card. Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. Your DTI ratio in this scenario is 40.

1200 400 400 2000 If your gross income for the month is 6000 your debt-to-income ratio would. Ad FHA loans are a great way to buy a home with little money as down payment. Multiply that by 100 to get a.

Web To calculate his DTI add up his monthly debt and mortgage payments 1600 and divide it by his gross monthly income 5000 to get 032. Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. But with a bi-weekly.

With this DTI ratio lenders. With a Low Down Payment Option You Could Buy Your Own Home. A DTI of 43 is typically the highest.

Bank We Offer Tools Resources For Navigating Home Loans From Start To Finish. 04 x 100 40. It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan.

Web Recommended DTI ratio. Web It is possible to buy a home with a high debt-to-income ratio. Apply Online Get Pre-Approved Today.

Web With more than half your income going toward debt payments you may not have much money left to save spend or handle unforeseen expenses. Web The debt-to-income DTI ratio measures the amount of income a person or organization generates in order to service a debt. Ad Compare Best Mortgage Lenders 2023.

Generally speaking most mortgage programs will require. Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates.

Web A debt-to-income ratio of 20 means that 20 of your income is going toward debt payments. Ad Tired of Renting. With a Low Down Payment Option You Could Buy Your Own Home.

A debt-to-income ratio of 50 or higher tends to indicate that you have high levels of debt and are likely not financially ready to take on a mortgage loan. Compare Now Find The Lowest Rate. Web To calculate your debt-to-income ratio add up all of your monthly debts rent or mortgage payments student loans personal loans auto loans credit card payments.

Save Real Money Today. Your credit score down payment loan-to-value ratio. Get approved for an FHA Loan Based of your credit score.

Web Heres an example. Web Over 50. Web Your monthly debt payments would be as follows.

Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late. Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. Web The Federal Housing Finance Agency has pushed back the implementation date of some of the adjusted fees set to apply to mortgages purchased by Fannie Mae.

Ad Use Our Comparison Site Find Out How to Get Home Loan Pre Approval In Minutes. A borrower with rent of 1200 a car payment of 300 a minimum credit card payment of 200 and a gross monthly income of 6000 has a debt. Web Debt-to-Income Ratio DTI In general mortgage lenders like to see a DTI ratio of no more than 36.

How To Get A Loan With A High Debt To Income Ratio 2023

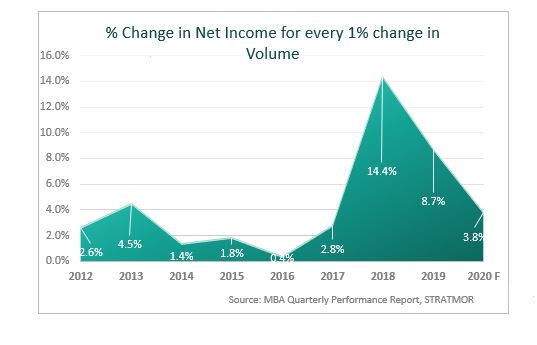

Bottle The Magic Three Lessons For Mortgage Lenders To Help Soften The Landing Stratmor Group

7 Loans For High Debt To Income Ratio Borrowers 2023 Badcredit Org

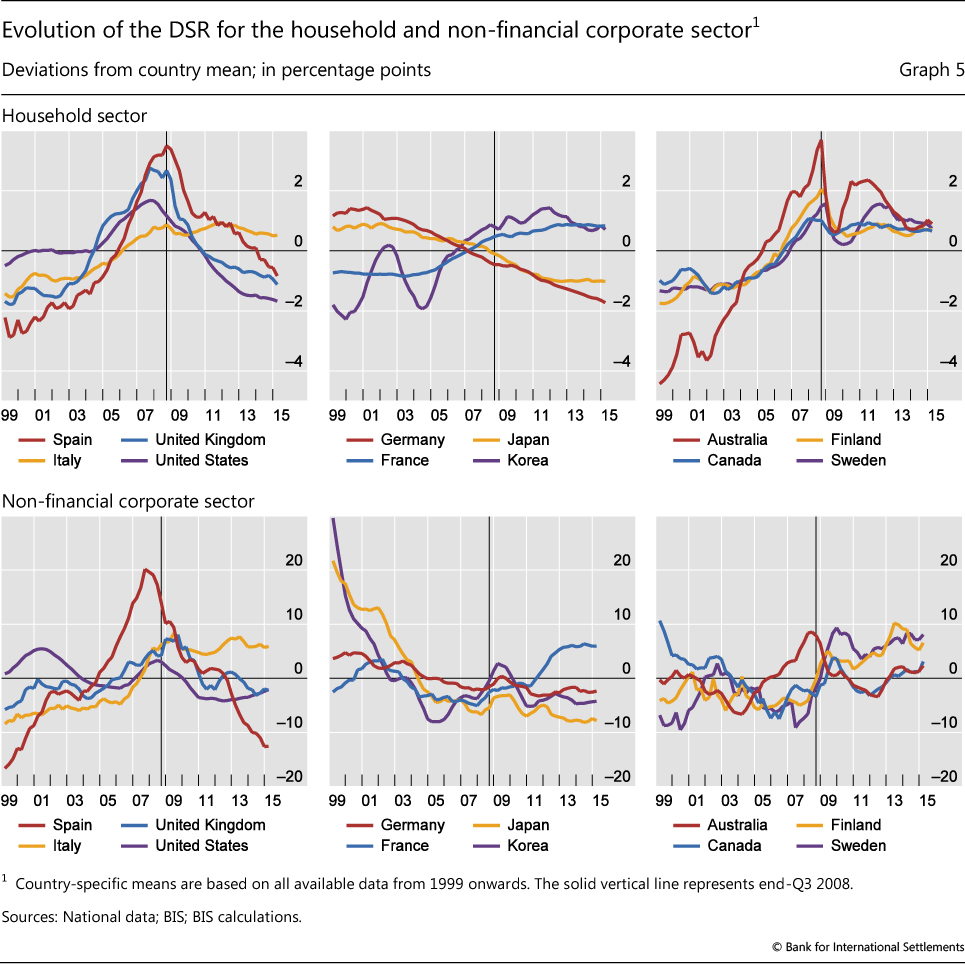

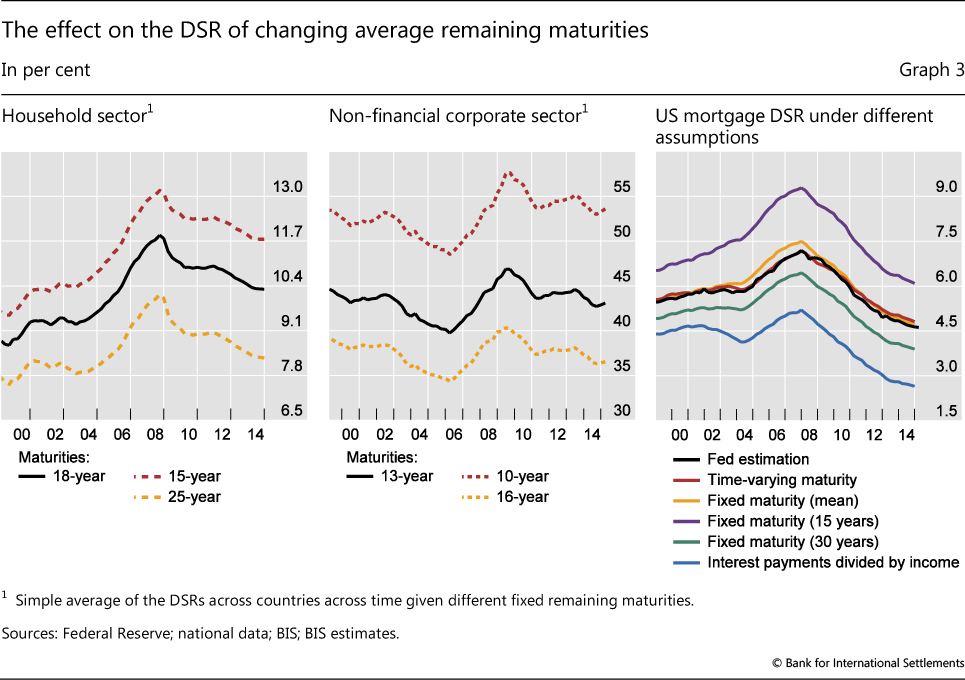

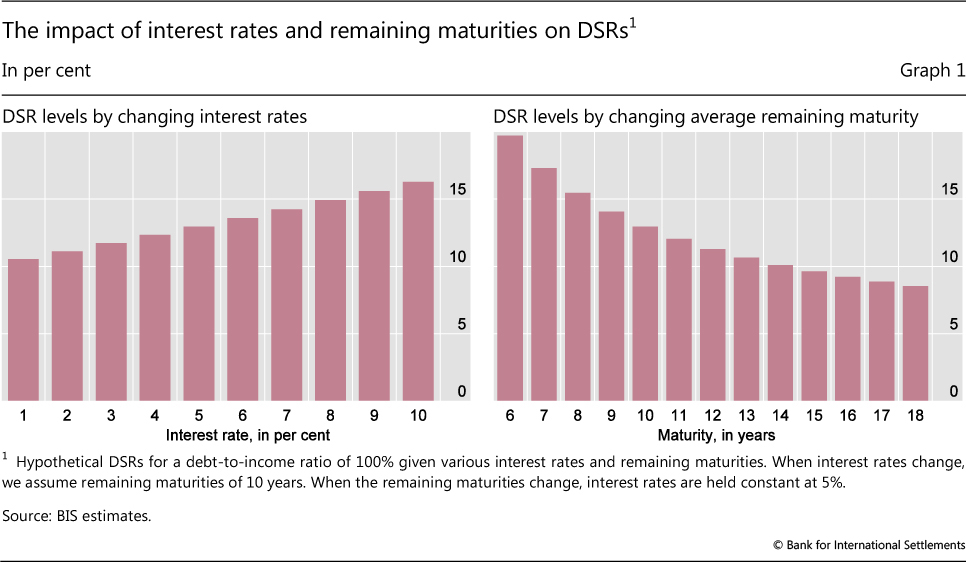

How Much Income Is Used For Debt Payments A New Database For Debt Service Ratios

How Much Income Is Used For Debt Payments A New Database For Debt Service Ratios

G7eolozx 97nkm

Mortgage Refinance Applications Are Collapsing What S The Impact On The Economy Markets Wolf Street

Mortgage Calculating Debt To Income Ratio Using Property Income Debt

Taxpayers Face 435 Billion In Student Loan Losses Already Baked In Leaked Education Department Study Wolf Street

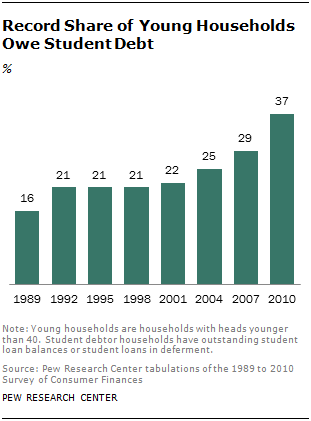

Student Debt And Overall Economic Well Being Pew Research Center

Instantly Approved Home Loans For High Debt Ratios Clear Lending

Mortgage With High Debt To Income Ratio

How Much Income Is Used For Debt Payments A New Database For Debt Service Ratios

High Dti Mortgage Lenders For 2023 High Dti Solutions

National Mortgage Professional Magazine January 2018 By Ambizmedia Issuu

Refinancing A Mortgage During Covid 19 Ratesdotca

7 Loans For High Debt To Income Ratio Borrowers 2023 Badcredit Org